Chapter 6: Financial Element

Focus and Content

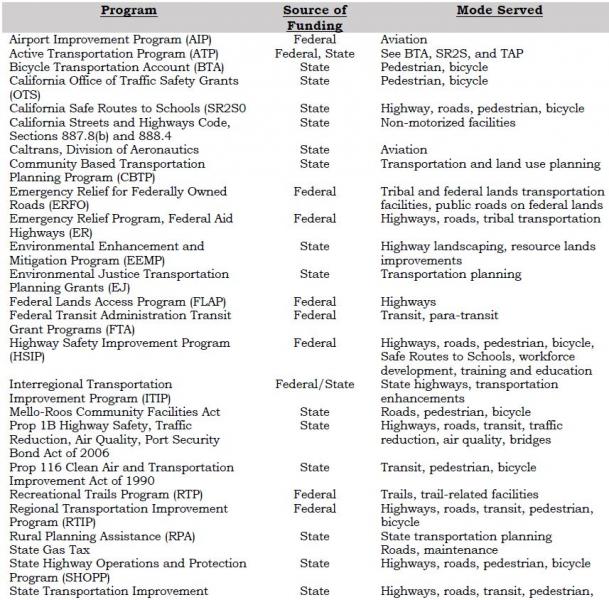

The Financial Element of the RTP must identify how the adopted transportation system can be constructed and maintained by providing “system-level estimates of costs and revenue sources that are reasonably expected to be available to adequately operate and maintain Federal-aid highways and public transportation” (23 CFR 450.322(f)(10)). In order to fulfill this goal, the Financial Element provides the following information:

- An overview of current federal and state transportation funding;

- A list of existing and potential revenue sources for transportation system improvements in Mono County;

- A list of financially unconstrained projects:

- A list of financially constrained projects (as presented in the STIP); and

- The identification of projects listed in the Regional Transportation Improvement Program (RTIP) and the Interregional Transportation Improvement Program (ITIP) and the inclusion of those projects in the Federal Transportation Improvement Program (FTIP).

Transportation Funding Overview

Federal Funds

Transportation funding for surface transportation programs, particularly for highways and public transportation, is funded largely by Federal transportation funds. The most current Federal Transportation Bill is MAP-21 (the Moving Ahead for Progress in the 21st Century Act), which allocates funding through FY 2013-14. MAP-21 eliminated some existing federal transportation programs, introduced new programs, and amended other existing programs.

Core programs in MAP-21 include the following:

- Congesting Mitigation and Air Quality Improvement Program (CMAQ);

- Highway Safety Improvement Program (HSIP);

- Metropolitan Planning;

- National Highway Performance Program (NHPP);

- Surface Transportation Program (STP);

- Transportation Alternatives Program (TAP); and

- Tribal Transportation Program (TTP).

These programs are funded primarily through the Highway Trust fund, which has two accounts, one for highways and one for mass transit. Revenue for the fund comes mostly from gas taxes, which are not indexed to inflation. As fuel consumption declines, revenues for the Federal Highway Trust Fund decline as well. Since 2008, Congress has transferred general funds to the Highway Trust Fund, but has not created any new, ongoing revenue for the Highway Trust Fund. Shortfalls in the Federal Highway Trust Fund will have a very real and serious trickle-down effect to the local level, resulting in insufficient funds to meet existing obligations.

State Funds

The State Highway Account (SHA) funds the State Highway Operation and Protection Program (SHOPP) for maintenance projects on the State Highway System. Unallocated SHA funds may also be used to make short-term loans to advance the capital-improvement phase of STIP-eligible projects, provided those projects meet certain criteria.

The SHA is also funded through gas taxes, which were indexed for inflation in 2013, for the first time in over 15 years. SHA funding continues to decline also as fuel consumption declines. In response, Caltrans has developed a 10-year “financially-constrained needs plan,” with an estimated total need of $2,082,000,000 annually in 2012 dollars to meet needs identified in the SHOPP.

The State Transportation Improvement Program (STIP) consists of two broad programs, the regional program funded from 75% of new STIP funding and the interregional program funded from 25% of new STIP funding. The 75% regional program is further subdivided by formula into County Shares. County Shares are available solely for projects nominated by regions in their Regional Transportation Improvement Programs (RTIP).

The STIP includes a listing of all capital improvement projects that are expected to receive an allocation of state transportation funds under Section 164 of the Streets and Highways Code, including revenues from transportation bond acts, as allocated by the California Transportation Commission for the following five fiscal years.

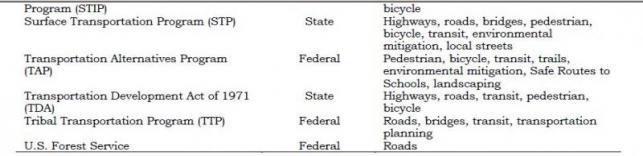

Transportation Funding Sources

This section contains an inventory of existing and potential new transportation funding sources that may be available for transportation system improvements outlined in the Mono County RTP over the 20-year planning period.

Airport Improvement Program (AIP)

The Federal Aviation Administration (FAA) provides funding for airport planning and development projects that enhance capacity, safety, security, and mitigate environmental issues. FAA grants have been utilized by the County and the Town for airport improvements. Funding is available through FY 2015 at 90% federal participation/10% local participation.

Active Transportation Program (ATP)

The Active Transportation Program consolidates various federal and state programs into a single program with the intent of making California a national leader in active transportation (biking, walking, other non-motorized transportation modes). The purpose of ATP is increased use of active modes of transportation and, in doing so, to increase safety and mobility, help achieve greenhouse gas reduction goals, enhance public health, ensure that disadvantaged communities share equally in the benefits of the program, and provide a broad spectrum of projects to benefit a variety of active transportation users. The ATP includes the Bicycle Transportation Account (BTA), the California Safe Routes to School (SR2S), Environmental Enhancement and Mitigation Program (EEMP), and the Transportation Alternatives Program (TAP).

Bicycle Transportation Account (BTA)

The BTA funds projects that improve safety and convenience for bicycle commuters in jurisdictions with an adopted Bicycle Transportation Plan (BTP). The BTA is now part of the ATP.

California Office of Traffic Safety (OTS) Grants

OTS grants fund bicycle and pedestrian safety and educational program on a competitive basis.

California Safe Routes to School (SR2S)

Eligible projects for SR2S funds include infrastructure projects in the vicinity of a school, as well as traffic education and enforcement activities within approximately two miles of an elementary or middle school. Other eligible non-infrastructure activities do not have a location restriction. SRTS infrastructure projects are eligible for TAP funds and may be eligible in the HSIP or STP. The SR2S is now part of the ATP.

California Streets and Highways Code Sections 887.8(b) and 888.4

These sections of State Code permit Caltrans to construct and maintain non-motorized facilities where such improvements will increase the capacity or safety of a state highway.

Caltrans, Division of Aeronautics, Grants and Loans

The California Aviation System Plan (CASP) identifies eligible projects for the State’s aviation funding programs. These programs provided grants and loans to eligible programs for capital improvements, land acquisition, and planning projects. Eligibility for some grants requires inclusion in the STIP. Includes Acquisitions and Development (A&D) Grant Program, Annual Credit Grants, Airport Loan Program, and State AIP Matching Grants.

Community-Based Transportation Planning (CBTP) Grant Program

This program provides funding for coordinated land use and transportation planning process that results in public engagement, livable communities, and a sustainable transportation system. Caltrans administers the program; for FY 2013-14 the grant cap is $300,000.

Emergency Relief Program for Federal-Aid Highways (ER)

Emergency Relief for Federally Owned Roads (ERFO)

These programs provide funds to repair federal-aid highways and roads on federal lands that have been damaged by natural disasters or catastrophes. The federal funds are meant to supplement state and local funds.

Environmental Enhancement and Mitigation Program (EEMP)

This is a State program funded by gas tax moneys, which provides grants to mitigate the environmental impacts of modified or new public transportation facilities. Grants are awarded in four categories: Highway Landscaping and Urban Forestry; Resource Lands; Roadside Recreation; and Mitigation Beyond the Scope of the Lead Agency. Grants are generally limited to $350,000. Grant proposals are evaluated by the California Natural Resources Agency; funds are administered by Caltrans. The EEMP is now part of the ATP.

Environmental Justice Transportation Planning Grants (EJ)

This program is administered by Caltrans and focuses on projects that address transportation and community development issues relating to low-income, minority, Native American, and other under-represented communities. The goal of the program is to improve mobility, access, safety, affordable housing opportunities and economic development opportunities for those groups.

Federal Lands Access Program (FLAP)

This program is a component of MAP-21, and is a replacement for the Federal Lands Highway Program. FLAP supplements state and local funding to improve transportation facilities that provide access to, are adjacent to, or are located within federal lands, particularly those that serve high-use recreation sites and economic generators.

Federal Transit Administration (FTA) Transit Grant Program

FTA grants provide funding for a variety of transit-related programs and activities.

- FTA Section 5304, Transit Planning Grant Program, provides funding for transit and/or intermodal planning studies in areas with populations under 100,000.

- FTA Section 5310, Elderly Individuals & Individuals with Disabilities, provides discretionary capital funds to meet the transportation needs of elderly persons and persons with disabilities. Grants may be awarded to public transit operators or private nonprofit organizations.

- FTA Section 5311, Rural Area, provides capital and operating expenses for non-urbanized transit systems in rural areas. A portion is set aside for Native American tribes.

- FTA Section 5311(b)(2)(3), Rural Transit Assistance Program (RTAP), provides funds for training, technical assistance, research, and related support services for transit operators in non-urbanized areas.

Highway Safety Improvement Program (HSIP)

A component of MAP-21 and a core federal-aid program that focuses on significantly reducing fatalities and serious injuries on all public roads, including non-State-owned public roads and roads on tribal lands.

Mello-Roos Community Facilities Act

This act allows local governments or districts to establish a Mello-Roos Community Facilities District (CFD) to provide for financing public improvements and services where no other money is available.

Prop 1B – The Highway Safety, Traffic Reduction, Air Quality, and Port Security Bond Act of 2006

Bond revenues for the following uses:

- Congestion Reduction, Highway and Local Road Improvements – for capital improvement projects to reduce congestion and increase capacity on state highways, local roads, and public transit;

- Safety and Security – for projects to protect against a security threat or improve disaster response capabilities on transit systems, as well as grants to seismically retrofit bridges, ramps, and overpasses; and

- Goods Movement and Air Quality – for projects to improve the movement of goods on state highways. Can also be used to improve air quality by reducing emissions related to goods movement and replacing or retrofitting school buses (that portion is administered by the California Air Resources Board).

Prop 116 – Clean Air & Transportation Improvement Act of 1990

Non-urban county transit funds can be made available for transit or non-motorized facilities. There has been some difficulty in approving allocations under Prop 116 due to the State’s fiscal problems.

Recreational Trails Program (RTP)

MAP-21 amended this program to make funding for recreational trails projects a set-aside from the State’s TAP funds, unless the Governor opts out in advance.

Rural Planning Assistance (RPA)

Rural Planning Assistance (RPA) funding is for state transportation planning activities and is allocated annually based on a population formula.

State Highway Operations & Protection Program (SHOPP)

The SHOPP provides funding for maintenance of the State Highway System. Projects are nominated within each Caltrans District office and are sent to Caltrans Headquarters for programming. Final projects approval is determined by the CTC, with funding prioritized for critical categories (emergency, safety, bridges, and pavement preservation). The State currently has insufficient funds to maintain the existing transportation infrastructure and there is no set formula for allocating SHOPP funds.

State Transportation Improvement Program (STIP)

The STIP is a five-year capital improvement program for the planning and implementation of capital improvements to the transportation system, including improvements to mobility, accessibility, reliability, sustainability and safety. The STIP includes two components, the Regional Transportation Improvement Program (RTIP) and the Interregional Transportation Improvement Program (ITIP). The RTIP receives 75% of the STIP funds, and the ITIP receives 25% of the funds.

The RTIP is prepared by the Mono County LTC and approved by the CTC as a part of the STIP, generally every two years. The ITIP is prepared by Caltrans and approved by the CTC as part of the STIP, although regional agencies can provide input and seek co-funding for specific ITIP projects in their region.

Surface Transportation Program (STP)

STP funding can be used for projects to preserve and improve the conditions and performance on any federal-aid highway, bridge, and pedestrian projects, including environmental restoration and pollution abatement. A portion of the STP is set aside for TAP and State Planning and Research.

Transportation Alternatives Program (TAP)

The TAP is a new program established by MAP-21 that provides funding for alternative transportation projects, including on- and off-road pedestrian and bicycle facilities, infrastructure projects for improving non-driver access to public transportation and enhanced mobility, community improvement activities, and environmental mitigation; recreational trail projects; safe routes to school projects; and projects for planning, designing, or constructing boulevards and other roadways largely in the right of way of former divided highways. TAP projects are not required to be located along Federal-aid highways. The TAP is a competitive program and is not included in the STIP. The TAP is now part of the ATP.

Transportation Development Act (TDA)

The Transportation Development Act (TDA) of 1971 created two funds primarily for public transportation: the State Transit Assistance (STA) account and the Local Transportation Fund (LTF). These are funded by a share of the state sales tax that is returned to the county of origin to support transit programs. In areas having no unmet transit needs, the funds may be spent for transportation planning or street and road purposes, at the discretion of the LTC. LTF funds are presently divided proportionately between the Town (55 %) and the County (45 %). LTF funds can be used as local matching funds for either state or federal funds. LTF funds are a traditional revenue source for Mono County and the Town.

Tribal Transportation Program (TTP)

The Tribal Transportation Program supports projects that improve access to and within tribal lands. Under Map-21, the TTP replaces the Indian Reservation Roads program, and adds new set-asides for transportation and tribal safety projects. Eligible activities include transportation planning, engineering, and maintenance, the construction, restoration, or rehabilitation of transportation facilities, environmental mitigation, and the operation and maintenance of transit facilities that are located on or provide access to tribal lands.

U.S. Forest Service

The USFS places a fee on all timber receipts from national forests. States then receive 25% of the receipts from timber sales within their boundaries, which are passed through to local agencies to benefit roads and schools in the counties where the sales occurred. In Mono County, this revenue becomes part of the county Road Fund, to be used for operational improvements.

Potential Additional Funding Sources

Other local funding sources may be available in Mono County should state and federal funding sources prove insufficient in the future, including funding for ongoing maintenance and rehabilitation projects for existing facilities. The following local funding sources could be used in Mono County and the town of Mammoth Lakes:

General Fund

Moneys come from a variety of sources, including property tax, business license tax, bed tax, motor vehicle in-lieu fees, and other fees levied by the Town and County. General fund moneys can be used to pay a portion of capital costs, or to cover budget items normally covered by LTF moneys. It is important that a local commitment be present to attract grant sources.

Development Impact Fees

Development Impact Fees may be available to offset potential transportation-related impacts identified for specific projects.

Public/Private Partnerships

Funding may be available from local agencies and private organizations. Recent cooperation between the USFS and the community of Lee Vining resulted in the construction of the Lee Vining community trail, and a local snowmobile enthusiasts group has helped develop signed snowmobile trails on public lands. In addition, it may be possible to obtain assistance from local groups and businesses in the construction and maintenance of bikeway facilities through a sponsorship program similar to the Adopt-A-Highway program implemented by Caltrans.

Other Local Sources

Other local sources may be available should state and federal funding sources prove insufficient for future projects:

Increase in Transient Occupancy Tax (TOT)

Condominium Use Tax

Local Gas Tax

Special Transportation Taxes

Fees and Charges for Services

Developers’ Contribution

Mitigation Fees

Revenue Bond

Lease Purchase Acquisition

Grants-in-Aid

Benefit Assessment Districts

County Service Area Improvement Area Bonds

Major Thoroughfare Fees

Finance Plan

Relationship Between the RTP Financial Element and the STIP

Most of the highway and road system in Mono County is either federal or state highways. As a result, the County relies heavily on the STIP and SHOPP to fund transportation improvements and maintenance projects on surface roads in the county. Projects in the Mono County RTP Financial Element are aligned with the STIP and the RTIP in order to provide consistency with those documents and in order to ensure maximum funding for projects in the county.

Existing Transportation System Operating Costs

Current projected transportation system operating costs for Mono County and the Town of Mammoth Lakes are shown in Appendix D. Those costs include the costs to operate and maintain the existing transportation system in Mono County, including the cumulative cost of deferred maintenance on the existing infrastructure. Current revenue projections for the operations and maintenance of the existing transportation system are also shown in Appendix D for both the County and the Town. For the County, Fiscal Year 2012-13 shows actual revenues & expenditures, FY 2013-14 is based on the current budget and the remaining are based on a 2% projected growth factor, except the General Fund which is projected to remain stable.

Costs & Revenue Projections for Transportation System Improvements

This section includes estimates of costs and revenue projections for transportation system improvements recommended in the Action Element, by mode and by recipient agency.

Revenues allocated for transportation purposes by Mono County have traditionally included revenues restricted to transportation uses, such as state fuel taxes (Streets and Highways Code Section 2104 and 2106), vehicle code fines, forest reserve payments, Local Transportation Funds, State Transit Assistance Funds, developers’ fees and direct assessment, and Federal-Aid Secondary. In addition, certain non-restricted funds have traditionally been used, including motor vehicle in-lieu fees, minor property rents, and federal revenue sharing. In recent years, the County has received transportation grant moneys for airport improvements and transit and has also appropriated General Fund contingency moneys when faced with emergency road repair needs.

Highways

Costs and revenue projections for proposed transportation system improvements on highways within Mono County are contained in the STIP and SHOPP (see Appendix D).

Local Roadways

Cost and revenue projections for eligible roadway construction and rehabilitation projects are contained in the STIP (see Appendix D).

Transit

Annual operating costs for transit services in Mono County are supported by LTF and STA funds. To provide sustainable funding for transit the Town of Mammoth Lakes has implemented year-round transit service. Those services are funded by a Transient Occupancy Tax (TOT) increment, along with a Transit Fee assessment, and/or funding from Transit Community Facilities District 13-003. These funding sources provide over $750,000 from the TOT and $220,000 from Transit Fee assessments. In addition, Community Facilities District 13-003 is expected to generate over $500,000 annually in the future.

Contract winter transit services are provided in the town of Mammoth Lakes to the Mammoth Mountain Ski Area, through an agreement with the Mammoth Mountain Ski Area. This winter service is privately funded and includes capital replacement costs. Summer Transit services are provided to the Reds Meadow Valley under a Special Use Permit with the USFS. One hundred percent of the operating funds for that service are provided though passenger fares.

Capital improvements to the system (e.g., bus purchases) are funded by grants or STIP funds. In addition, funds may be available for capital and expense requirements for design, development and implementations of the Eastern Sierra rural ITS transit system (i.e., bus-stop/electronic kiosks in town and county communities; bus-to-bus communications equipment) and transit management equipment.

Interregional Connections

Recommended actions for interregional connections include continued participation in YARTS and the Sierra Nevada ITS Strategic Plan planning process. Mono County contributes funding to YARTS annually.[18] The Action Element also recommends continued participation in the intercity transit planning process with Inyo and Kern counties and Caltrans, and the collaborative planning process with Inyo, Kern, and San Bernardino to pool STIP funds for priority projects. Neither of those collaborative planning processes currently has any associated hard costs.

Aviation

Project funding for identified short-term capital improvements at County airports is anticipated to come from a combination of FAA Airport Improvement Program grants (90%) and local match (10%). Projected costs for improvements at the Lee Vining Airport and Bryant Field are shown in Appendix D. Project funding for identified improvements at the Mammoth Yosemite Airport is anticipated to come from a combination of FAA grants (approximately 90%) and local match (approximately 10%). Projected costs for improvements at the Mammoth Yosemite Airport are shown in Appendix D.

Non-Motorized Facilities

Improvements to non-motorized facilities in Mono County have been included in the STIP. RTP policies call for the provision of bike lanes as a component of rehabilitation projects on streets and highways. The Town of Mammoth Lakes adopted policies in the 2007 General Plan to reduce vehicle trips and promote healthy communities by promoting feet first, transit second and automobile last. This policy is being implemented through project development review and Town-sponsored projects. In addition, the Town’s recent zoning update included development standards promoting pedestrian, biking, and alternative modes of transportation.

Financially Constrained Projects

This section contains a list of financially constrained projects for which funding has been identified, or is reasonably expected to be available within the RTP planning horizons (short-term and long-term). See Appendix D for the current STIP.

Financially Unconstrained Projects

The Mono County LTC has developed a list of financially unconstrained projects (projects that are both necessary and desirable should funding become available), which is included in Appendix D.

Potential Funding Shortfalls or Surpluses

Current funding sources are insufficient to maintain or even modestly improve Town and County road systems. Many roads in community areas throughout the county are unimproved private roads that have not been accepted in the county Road Maintenance System because of their substandard conditions. Liability issues and funding shortages impede the County's ability to accept ownership of substandard private roads. Maintenance of these roads therefore depends on private funding, which is often inadequate. Future additions to the County road system will be improved since it is the County's policy to require developers to pay for appropriately engineered streets for each new subdivision.

The fact that Mono County has a resident population of 14,202 persons according to Census 2010 and a private land base of only 6% of its total area severely limits the availability of funding for improvements to its transportation system. State redistribution of gas tax revenues and other transportation funds is based primarily on the resident population of each county and length of road system. Factors such as origination point of funds, traffic volumes, recreational benefits, travel alternatives, and need are given little weight in the State distribution formula. Mono County with its small resident population does not qualify for sufficient funding to address the impacts of the large tourist traffic volumes experienced in the county.

[18] The funding contribution for FY 2014-15 was $30,000.